Decouple Mondays #6: Bitcoin breaks its relationship to gold and stocks as new highs get closer

Weekly update (ending Nov. 27) on Bitcoin's correlation with the S&P 500, the Nasdaq, and Gold.

Welcome to Past the Limbo, a weekly newsletter where Bitcoin and crypto meet traditional markets. Subscribe below to start receiving data-based insights each week.

This is the sixth edition of Decouple Mondays, a weekly update on Bitcoin’s correlations with the main traditional assets in the market, updated each Monday morning (8 am EST).

Let’s get to it!

Short-Term Market Action

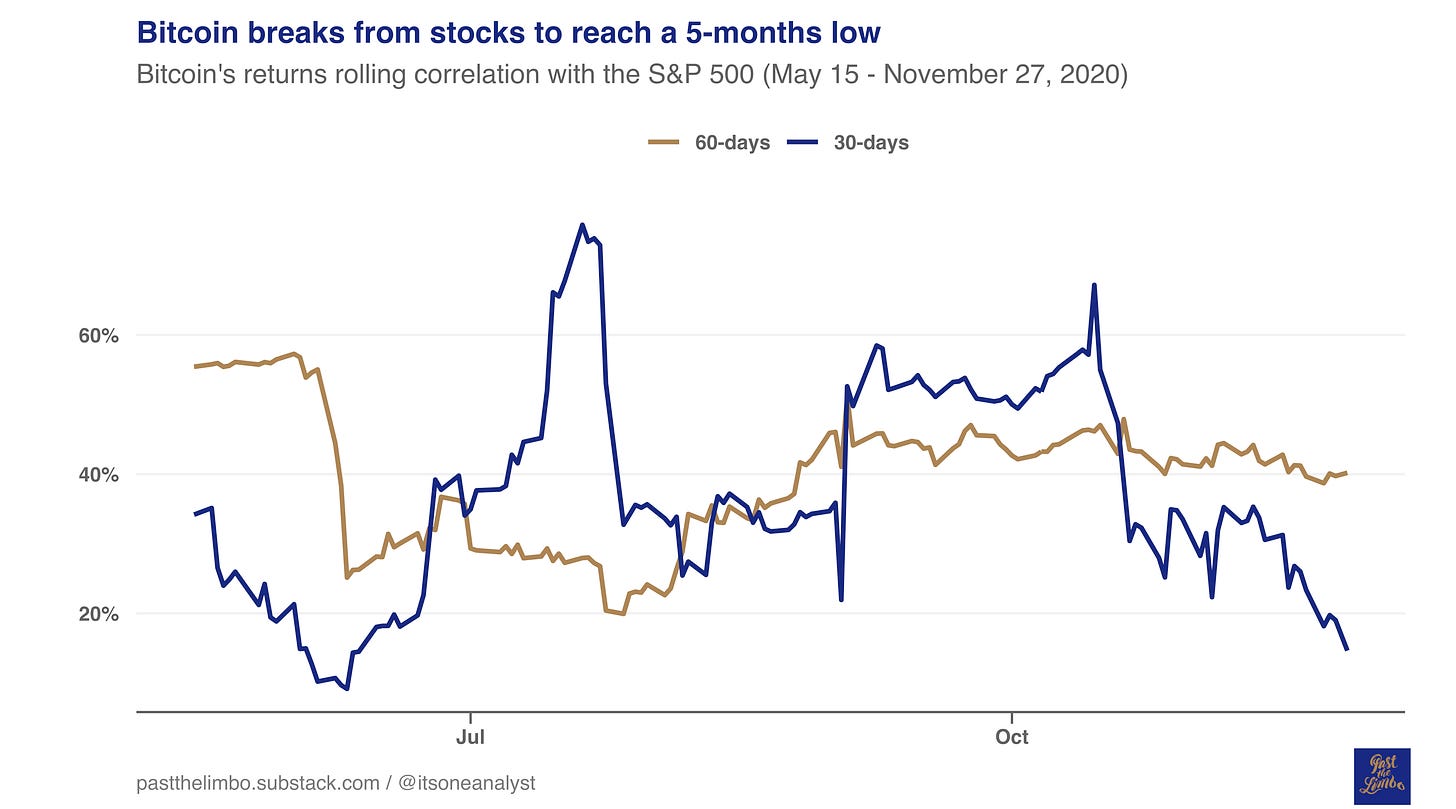

Bitcoin broke from the S&P 500 to a 5 months-low

Amid Bitcoin’s price surge, its correlation with stocks, measured with the S&P 500, is on a decreasing trend for the last 2 weeks.

As Bitcoin dipped this week to hover around 16,500$ on Friday, its correlation with stocks continued the downwards trends as the S&P gained slightly above 1.5%.

As a result, the 30-days correlation between the S&P 500 and Bitcoin reached its lowest value since June.The last day of the week registered a correlation of 14.6%, from 23.35% last Friday.

During the last weeks, we have been discussing on Decouple Mondays the prospects of a new Bull-run causing the decoupling from stocks, which even with the recent sharp drop of 10%, continued its trend.

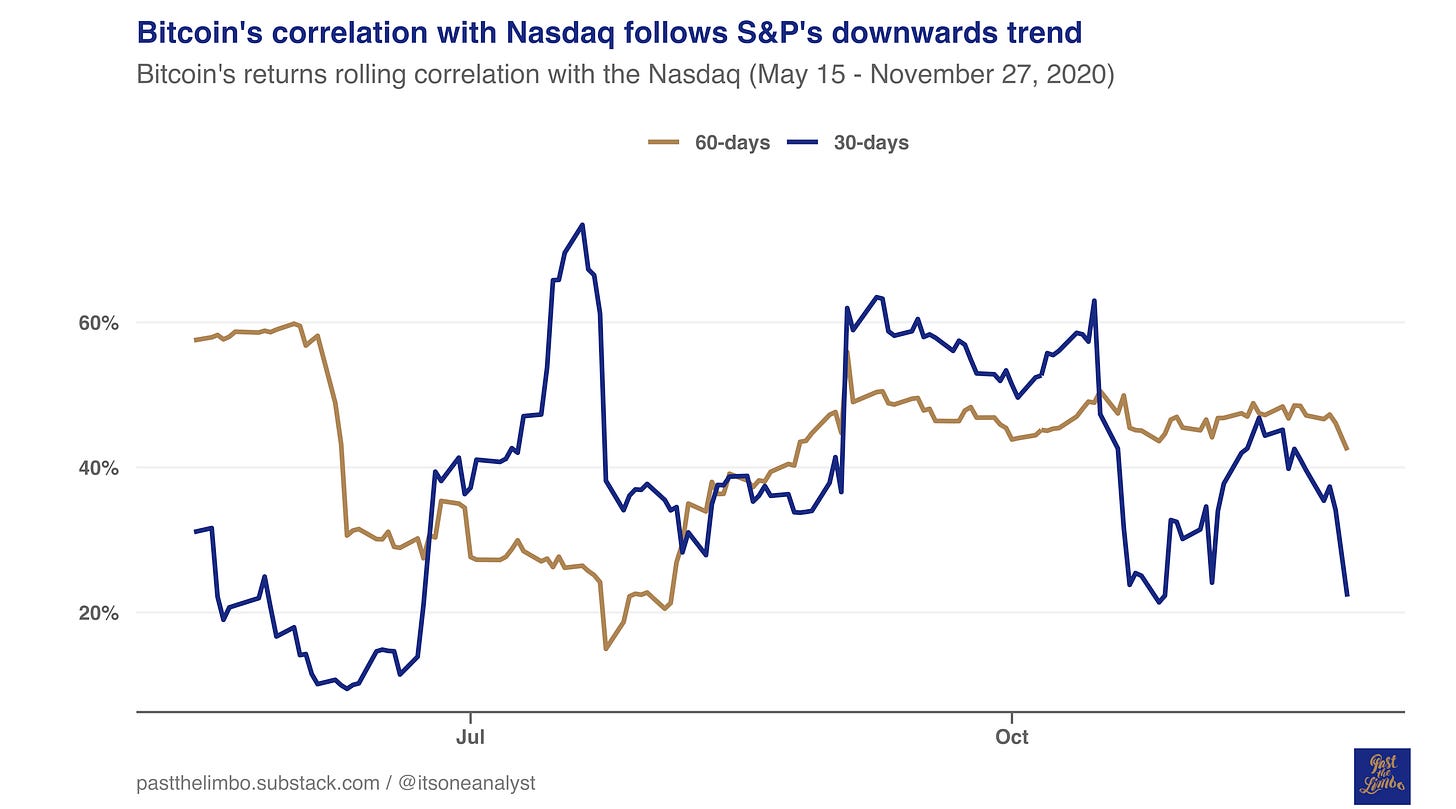

Bitcoin’s relationship with the Nasdaq follows the S&P’s fall

Bitcoin's returns correlation (30-days rolling) with the Nasdaq turned-around since the beginning of November but has now followed the same behavior as the S&P 500.

As a result, this week's 30-days rolling correlation finished at 22.18% from 39.6% last Friday.

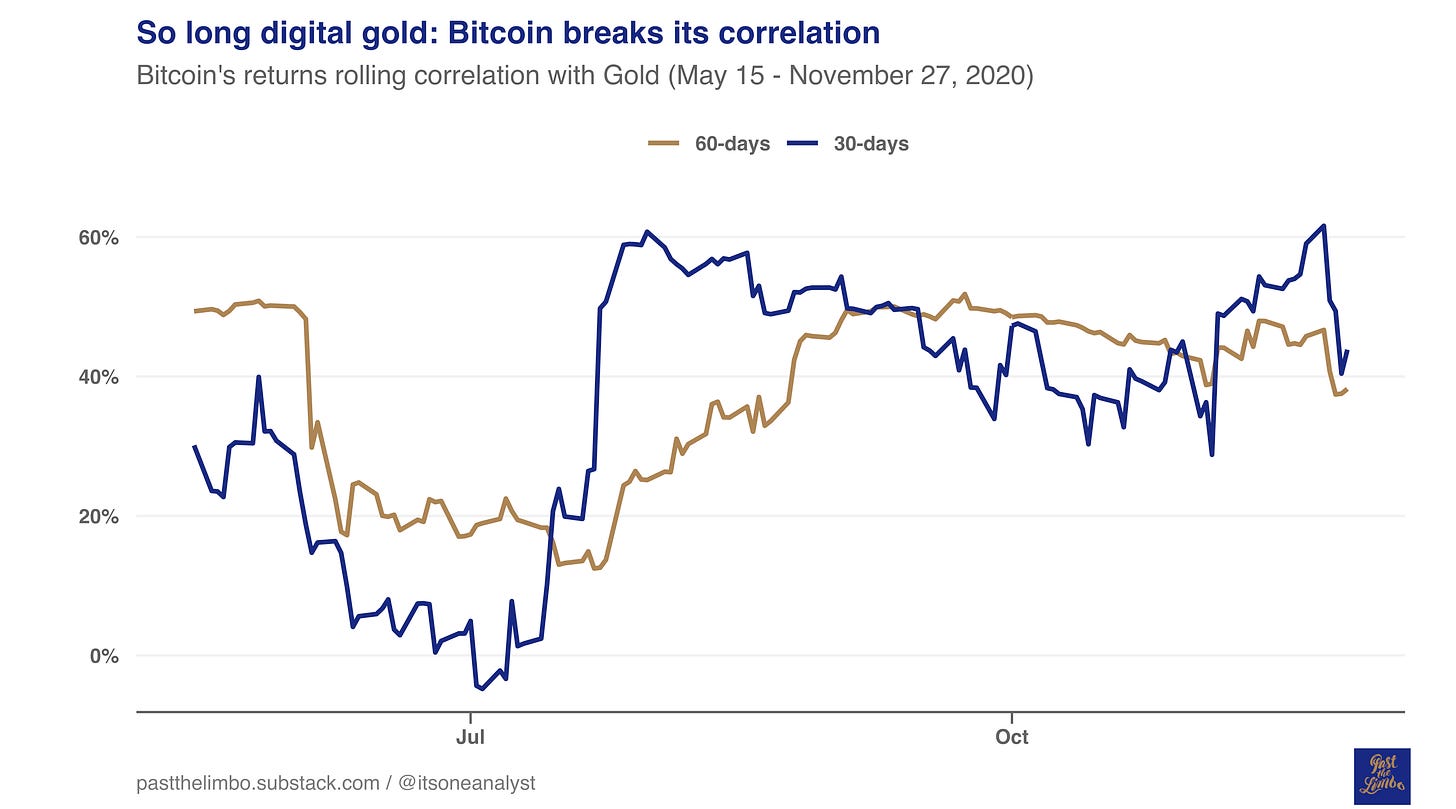

Bitcoin breaks its correlation to Gold amid price dump

Amid Bitcoin’s recent bull-run, its correlation with Gold increased in the last 2 weeks, breaking a slight downwards trend.

However, since Tuesday, when Bitcoin almost reached its previous all-time high, its correlation (30-days rolling) to Gold broke to 50% from 61.6% on Monday.

As a result, Gold and Bitcoin's 30-days rolling correlation finished this week at 43.8%, a clear difference from last Friday (59.04%).

Looking at the last 60-days correlation, the decreasing trend of the last two months came back with the recent price dip.

Long-Term Market Action

This week’s update - Bitcoin’s correlation with each asset between January 1, 2020 - November 27, 2020:

S&P 500: 48.55%

Nasdaq Composite: 49.76%

Gold: 40.56%

Bitcoin’s YTD correlation with the main traditional assets went down slightly this week amid the recent drop. However, in 2020, Bitcoin’s correlation with these assets has been very high in comparison to other years. However, Bitcoin is still a non-correlated asset in the long-term. This week’s update (between July 20, 2010 - November 27, 2020) of Bitcoin’s correlation with each asset:

S&P 500: 9.86%

Nasdaq Composite: 9.48%

Gold: 7.75%

What lies ahead?

Bitcoin dropped by 10%, recovering during the weekend to hover around the $18.7K this Monday, giving hopes of a new rally this week. After testing new highs, this correction seems on par with the previous upwards price trend.

As we’ve been analyzing week over week, Bitcoin seems poised to reach an all-time in the short-term amid strong fundamentals while breaking away from other assets except for gold during some timeframes.

When will Bitcoin reach its previous all-time high? Leave your comments below and let’s get the discussion going until the next edition of Decouple Mondays. Stay tuned!

If you want to support this journey, please subscribe below and start receiving Decouple Mondays and other crypto analysis every week in your inbox!

Data sources: Bitcoin daily price data from Coinmetrics.io; S&P 500 and the Nasdaq adjusted closing price data from Yahoo Finance; Gold price data (LBMA PM) from Gold.org

Image use: If you want to use any of the graphs published, please feel free to reach me @itsoneanalyst and I’ll send the images with the highest quality possible.

Disclaimer: This newsletter does not represent any kind of investment advice and it is intended as informational only. In any kind of investment activity, you should conduct your own research and evaluate at your own risk. A word of caution: Correlation does not mean causality.